Checking a crypto wallet for connection with “dirty” money will allow:

PROTECT YOURSELF FROM "DIRTY" ASSETS

knowing the origin of counterparty funds

PREVENT BLOCKING OF FUNDS

due to high risk score

GET OUT OF TROUBLE WITH THE LAW

on suspicion of money laundering

You don't have to do anything bad to get blocked

— it is enough not to be interested in the history of the origin of funds of counterparties

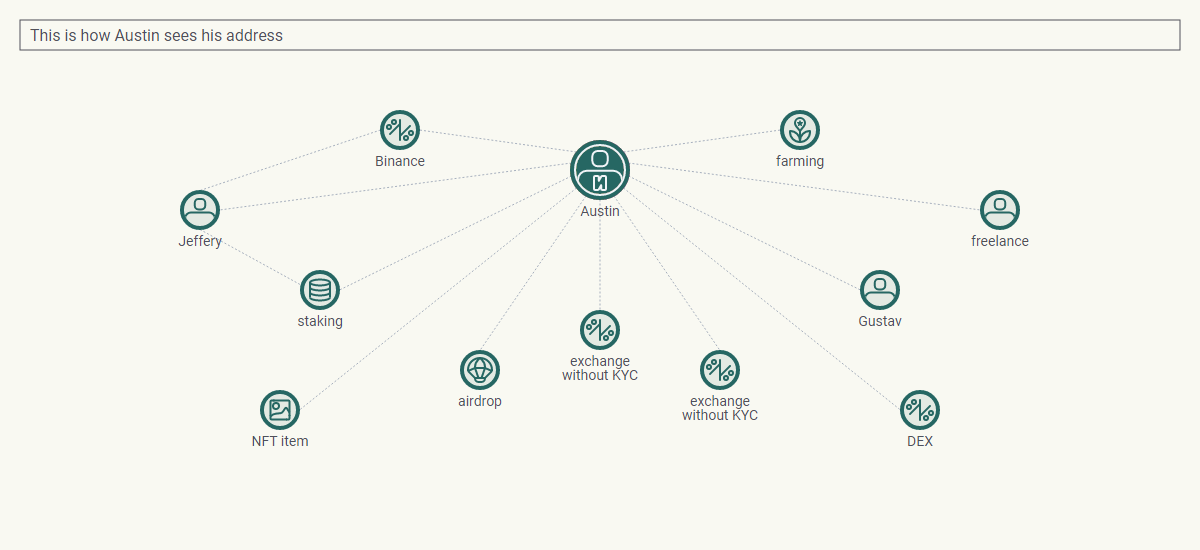

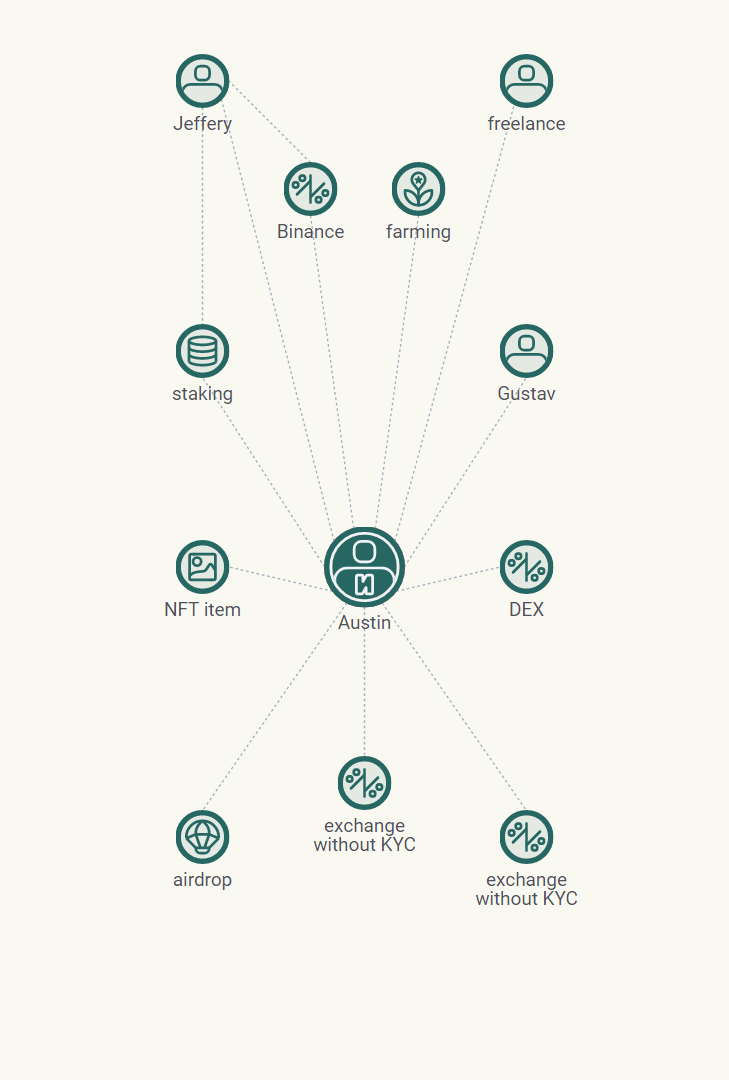

Let’s imagine Austin , a 28-year-old crypto user living in a large city and working as a systems analyst in a successful IT company. His stable salary is complemented by additional income from various freelance projects, which allows him to periodically invest in cryptocurrencies.

Austin was introduced to the world of cryptocurrencies by his childhood friend Jeffery , a professional gamer who is actively involved in staking. The first fiat-to-cryptocurrency exchange deal was made with Jeffery, as there was a high level of trust between them.

Then there were attempts to make money on airdrops. Once even managed to get a small reward.

Jeffery also taught Austin how to use DEX , so that Ivan could earn money by participating in farming and staking .

Austin registered on the Binance cryptocurrency exchange. Sometimes he was engaged in arbitrage and concluded profitable deals in the P2P (peer-to-peer) format. When he needed cash, he easily found crypto exchangers with favorable rates on the Bestchange platform.

Of the users, Austin had only 2 counterparties – the friendship of Jeffery and Gustav .

In addition to his main job, Austin also did freelance work, and in some cases, he received payment in cryptocurrencies from his clients.

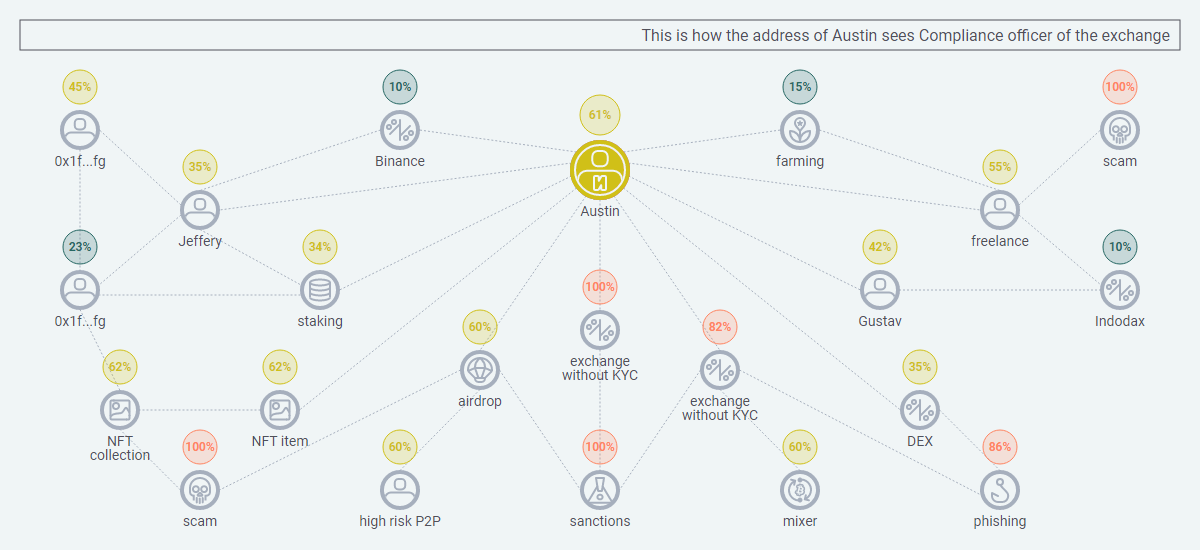

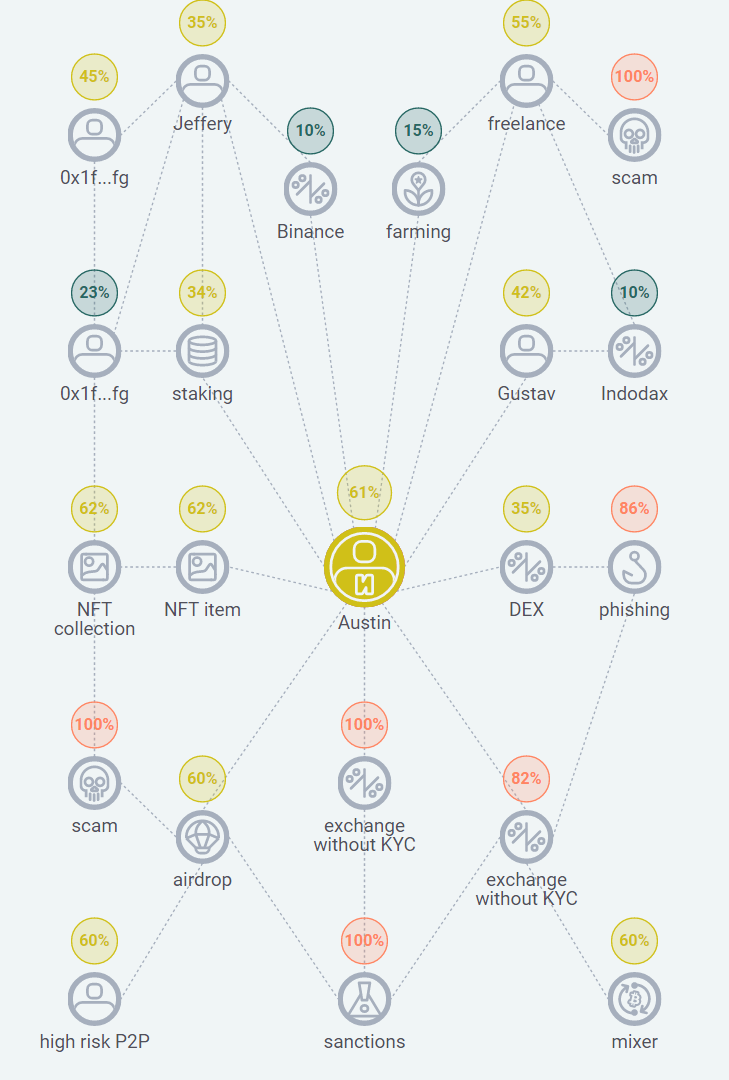

It is important to note that Ivan has never purchased anything on the dark web , nor has he been involved in fraudulent schemes in P2P exchanges. However, recently when depositing another amount from your crypto address to the Binance deposit address, the account was blocked in accordance with AML advertisers. Now he needs to provide a history of the origin of the funds. Where can I find all these correspondence with users of P2P transactions, transactions in crypto exchangers, deposits and withdrawals from stock exchanges, addresses of payers in the crypt for freelancing…

And the likelihood of these problems could have been avoided if I had checked counterparties and myself before sending funds to the exchange.

Don’t be like Austin. Check Your Risk Score before interaction with counterparty.

Read More

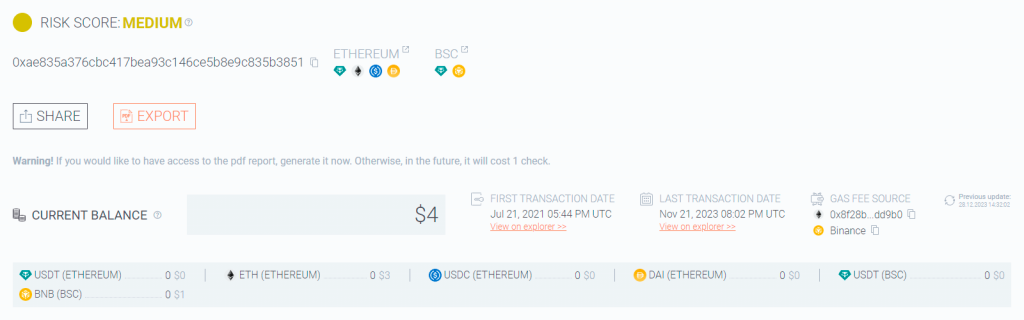

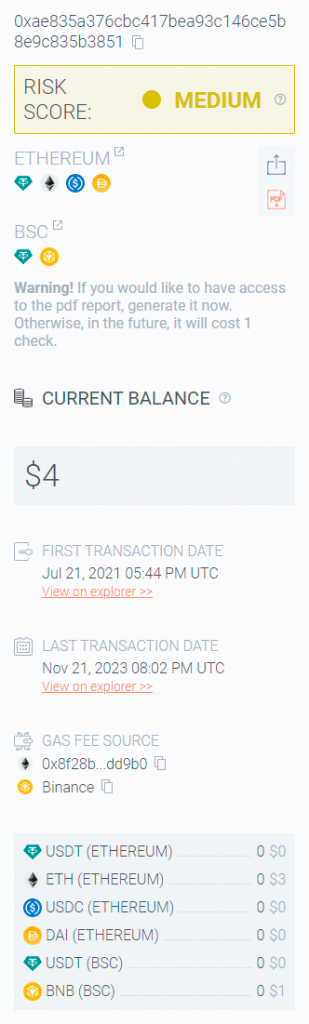

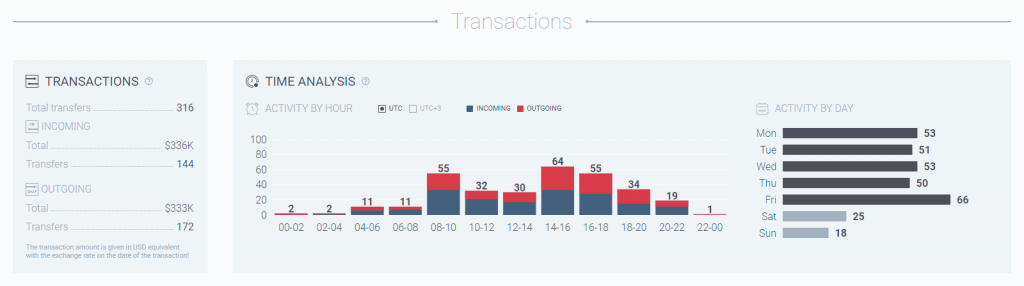

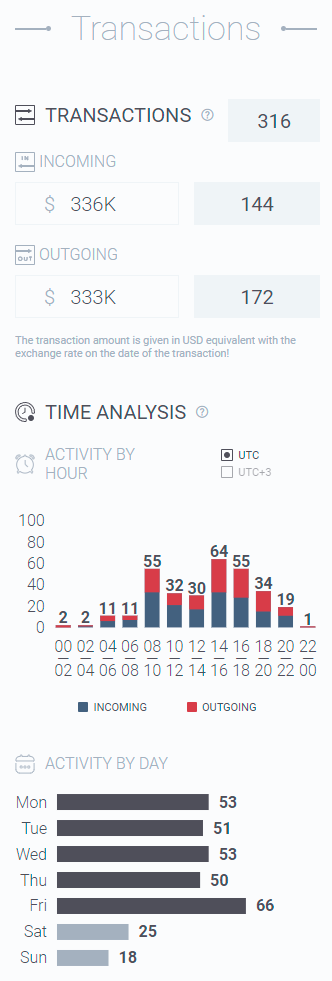

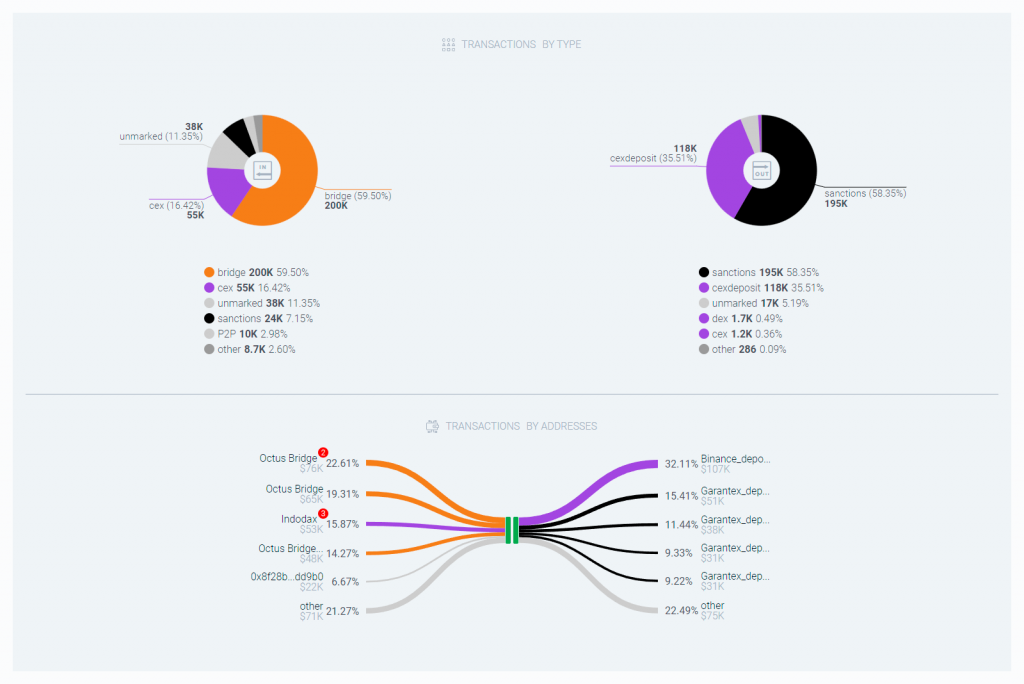

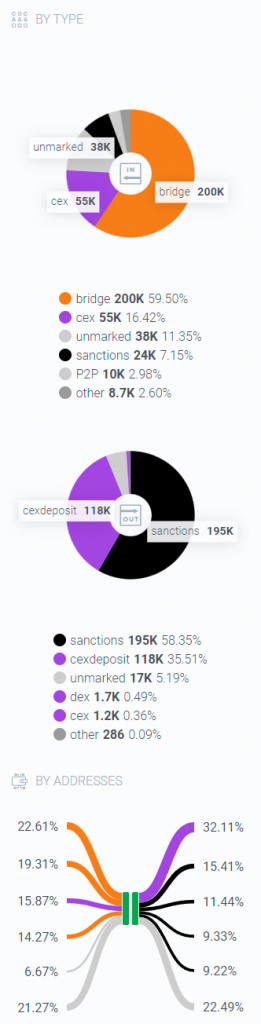

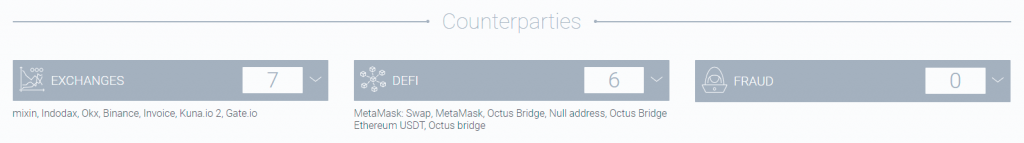

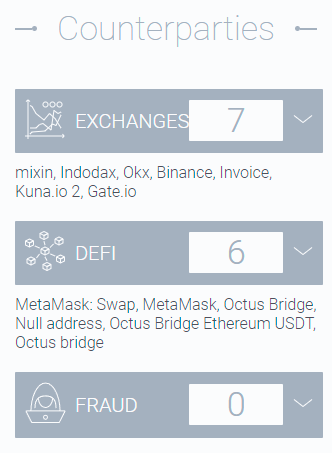

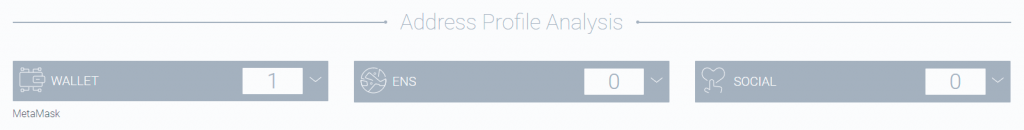

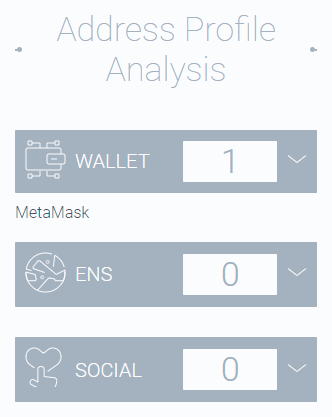

This is how the address of Austin sees

Check crypto wallet in 3 seconds. Free.

Why is it important to check?

Loss of your time searching for correspondence on all receipts

Most users do not store information about their exchanges on exchanges, P2P transactions, information about the circumstances of receiving funds to their address

Inability to find evidence of a particular transaction

Sometimes you can be asked for information about transactions that you made 3 years ago

Requirements of the exchange / exchanger to provide additional information about yourself

(address of residence, passport photo, bank statement, …)

The risk of being involved in a criminal case if transactions between you and the addresses of the attackers were in transit

Refusal to work with you if you have a high Risk Score on the part of services and counterparies.

You expected to quickly exchange the crypto and resolve our issue, as a result, the crypto is blocked, the unlock process takes months

Report Structure

FREE INFORMATION

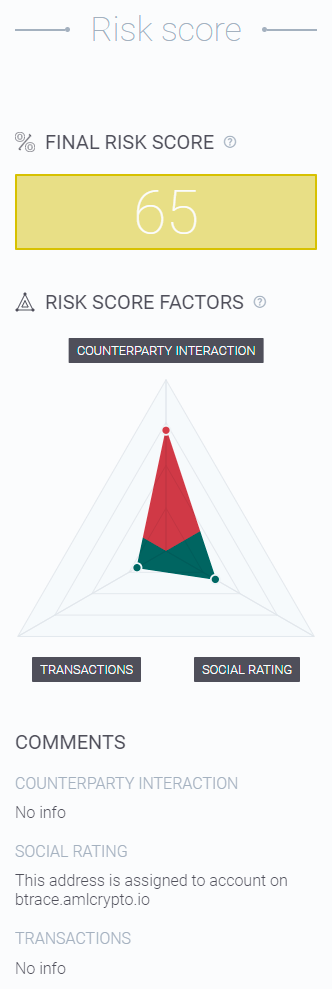

RISK SCORE AND RISK FACTORS

TRANSACTION ANALYTICS

ADDRESS COUNTERPARTY ANALYTICS

STRUCTURE OF OUTGOING AND INCOMING FUNDS

KNOWN DATA ANALYTICS AT ADDRESS

The price of security for your cryptocurrencies

Check Quality Assurance

Check it out for free – we will give you a unique opportunity to look at cryptocurrency wallets through the eyes of an exchange compliance manager and see how our service works in practice.

FIRST

CHECK FREE

THE BEST PRICE ON THE MARKET CHECK FREE

Best Price Guarantee

The service is built on our own technological base, so we give a better price than any third-party solution reseller.

FAQ

This is a percentage risk score expressed as a value from 0 to 100, which takes into account the history of the formation of funds on a cryptocurrency address, the likelihood of being associated with illegal activity, user behavior, as well as known information about the address, its cluster and owner.

When receiving dirty funds to your cryptocurrency address, you need to:

- Stop accepting new funds to this address until all circumstances are clarified.

- Collect all information about the origin of funds.

- Be ready to undergo extended KYC, structure information about the origin of your transactions, enriching the data with evidence (screenshots of correspondence, letters confirming exchange transactions, …).

- Be as open as possible when communicating with VASPs (crypto exchangers, exchanges, …) or law enforcement agencies when inquiries arise.

It is possible to improve the Risk Score, but the higher the Risk Score of the address and the more transactions it contains, the more difficult it will be to do.

When lowering the Risk Score of an address, there are several factors to consider:

- Reducing the Risk Score is possible only if the address is in the green zone (0% -39%) risk or the yellow zone (40% -69%) risk

- The Risk Score is based on the source of origin of funds, therefore, if the address has most of the funds of high-risk origin, then it is practically impossible to reduce its Risk Score

- Reducing the Risk Score by adding information that reveals the identity of the owner is possible only if the address is new with small turnover.

Address verification is a verification of the sources of formation of funds on a crypto address. This information will help to make a decision about the risks of a transaction with this counterparty before the transaction.

Transaction verification is a verification of the volumes of high-risk funds in the transaction. In other words, the counterparty address has a certain Risk Score, which is primarily based on the sources of funds. When interacting with a counterparty, the machine learning algorithm calculates the share of risky assets in the transaction amount and provides information about the Risk Score of the transaction.

It is important to note that the Risk Score of an address may not be equal to the Risk Score of a transaction with that address.

At the moment, Btrace analyzes the main tokens of the Ethereum network, the BSC network, the Bitcoin network, the TRON network and the Everscale network. In Q4 2023, TVM networks (TON, Venom) will be added. All currently supported networks can be found in our documentation.

It is important to keep in mind that the risk score depends not only on your actions, but also on the actions of your counterparties, which, in turn, depend on their counterparties. Risk-score addresses may change over time, even if it does not carry out any transactions. This is due to the fact that one of your counterparties could become a participant in high-risk transactions, thus partially affecting you. Also, if you interact with a crypto exchange or an exchange that does not care about AML procedures, this can also have a negative effect on your address, especially if it ends up on sanctions lists as a result. If you don’t agree with your risk score, you need to understand if there are any dirty assets in your environment. Further, you can provide us with extended information about your counterparties (thus indicating the origin of funds), so the degree of their influence on your address can be reduced after manual verification.

Risk-score addresses are recommended to be done prior to each interaction. This applies to both checking your counterparties and your own address. Checking your counterparties prior to transfer will allow you to exclude the possibility of high-risk funds being credited to you. It is advisable to check your own address before sending VASP (exchanges, exchangers). This will help keep your funds from being blocked.

The report is relevant only on the date and time of its formation. The very fact that you’ve been checking shows your due diligence.

AML Crypto specializes in the development of blockchain analytics tools, countering the laundering of dirty assets through cryptocurrencies. Our main tools are Bholder, Btrace, KYT Monitoring.

- Bholder is a connection graph that allows you to visually explore the flow of assets between crypto addresses.

- Btrace – a tool that allows you to generate reports in terms of address key information, its risk score, risk factors and transaction analytics.

- KYT monitoring is a tool for VASP compliance departments that allows you to automate the process of scoring a large number of crypto addresses.

You can pay for the service using:

- Debit/Credit card. The term of replenishment depends on the issuer of the bank, on average, replenishment takes from 1 to 3 minutes.

- Cryptocurrencies. The term of replenishment depends on the workload of the network in which you replenish, on average, replenishment takes from 1 to 10 minutes.

- For legal entities, payment to the company’s current account is possible.

You can always replenish your balance here. Checks have an unlimited duration, and an unlimited scope.

Personal data is processed and stored in accordance with the GDPR. We also recommend that you read the sections “User Agreement” and “Privacy Policy”

We are guided by the recommendations of the FATF (Intergovernmental Organization for the Development of Intergovernmental Action against Money Laundering), Travel Rule (FAFT document that crypto companies must follow), 6AMLD (European Union Anti-Money Laundering Directive), AML / CFT and PF (anti-money laundering) of proceeds from crime, financing of terrorism and financing of the proliferation of weapons of mass destruction)

We obtain crypto address labeling data from various sources, which include publicly available databases, specialized databases, and data obtained from the work of our analytical tools. We also use machine learning and analytical algorithms to process large amounts of data and identify the behavior of crypto addresses associated with various risks. It is important to note that we strictly comply with all relevant rules and laws regarding data processing and privacy. Our goal is to provide reliable and up-to-date data that will help our clients make informed decisions in the field of cryptocurrency transactions and comply with anti-money laundering and counter-terrorism financing requirements.

What is risk score?

What is risk score?